Hello!

Please enjoy the October Deal Flow Digest, a monthly newsletter recapping recent Crypto / web3 funding rounds.

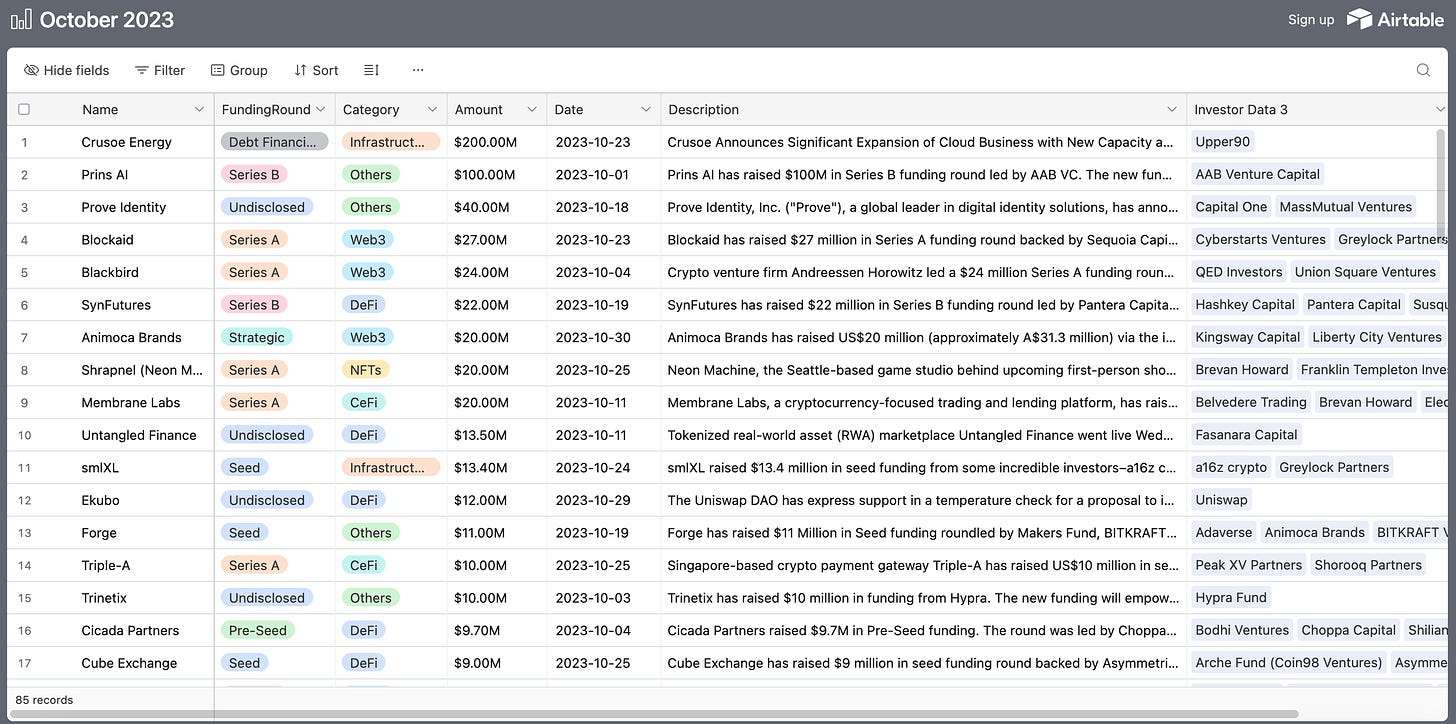

Be sure to check out the Airtable below with ALL the deals, and the recent hackathon/demo day results (in the links).

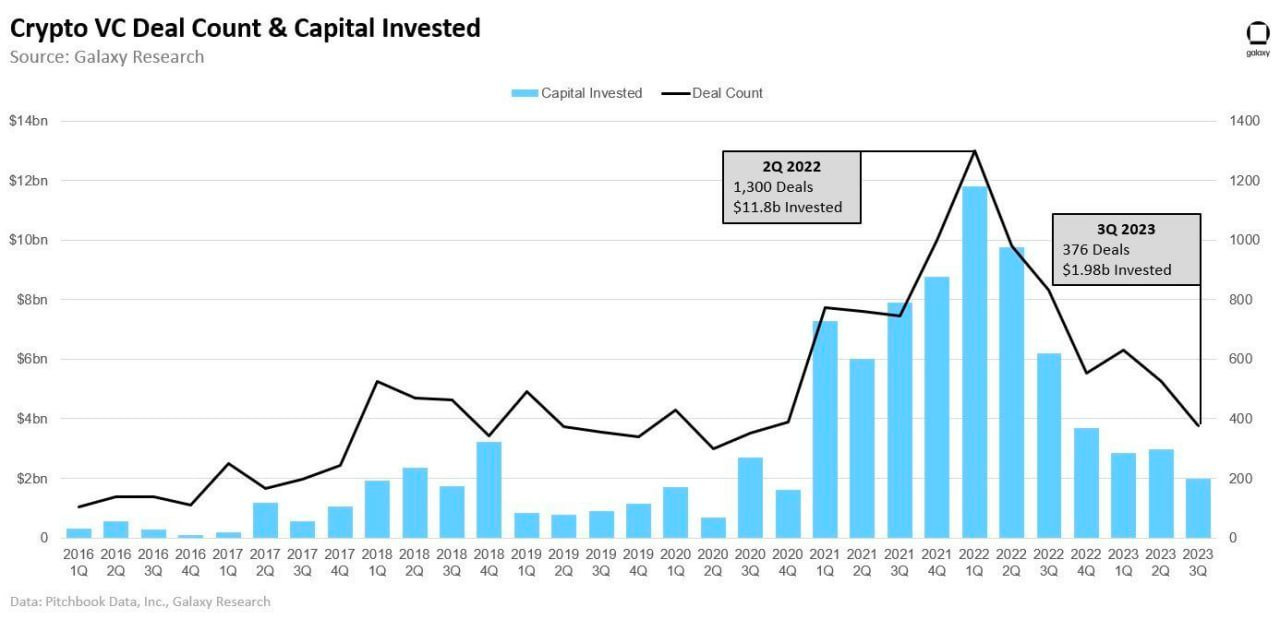

3Q23 Fundraise Details

Third Quarter is now behind us and it still feels like Crypto VC still hasn’t bottomed.

Second Quarter was also ugly and with quarterly numbers like these… even though we love to say “We’re so back”, it’s difficult to call a bottom yet.

In terms of both count of deals and total capital invested, Q3 was the lowest quarter since Q4 2020. Both of these numbers are still ~double what they were in the 2017-2020 market, but continue to trend down.

Interesting to see that despite difficult regulatory uncertainty in the US, most of these deals (~35%) are still based in the US. However, the US is notably losing share on deal count & capital deployed to countries like UAE, Singapore, and UK - all of which have more progressive crypto frameworks.

For founders, it’s difficult to raise new rounds but keep in mind that there still is plenty of capital out there. Sometimes, however, it all seems to be chasing the same hot deals. Many startups have failed to find meaningful product-market fit - and will need to focus on finding sustainable business models now that the more speculative source of funding is drying up. Either way, for venture-backed startups it looks like they’ll continue to face a tough fundraising environment for the foreseeable future.

Bitcoin

It’s Halloween and I’m at the Solana Breakpoint event in Amsterdam. Even here in Amsterdam, loads of people are dressed up, pumpkins carved, etc. It’s Halloween after all. October 31 every year comes and the first thing many people think about is Halloween.

Yes, the 31st of October is Halloween, however, it is also a significant day within the Cryptocurrency / Blockchain / Web3 industry. On this day, 31-October-2008 - now 15 years ago to the day - the Bitcoin whitepaper was released.

Last week, visits to Bitcoin’s Wikipedia page hit nearly 13,500 on Oct. 24 — the highest interest the page has received since June of 2022. This renewed interest is very much related to the recent BTC price rally as well as the promising ETF news last week. As I wrote in June, it appears the institutions are finally “coming” for our crypto :)

A quick recap of the timeline of events in 2008/2009 that led us to where we are today with an ETF on the horizon:

18-Aug-2008 - bitcoin.org was registered

31-Oct-2008 - Whitepaper released, authored by Satoshi Nakamoto titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” It was posted to a cryptography mailing list.

3-Jan-2009 - Bitcoin Network live, with Satoshi Nakamoto mining the genesis block of bitcoin (block number 0), which had a reward of 50 bitcoins.

Embedded in the genesis block was the text: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” - referring to a headline in The Times published on 3-Jan-2009.

We’ve made quite a bit of progress from this initial block 15 years ago, despite the recent setbacks.

Want to feel inspired by the early crypto ethos? Want to remember “Why we are here”? Can’t recommend enough to take a few minutes and watch Eric Voorhees’ talk from Permissionless. It was epic IRL:

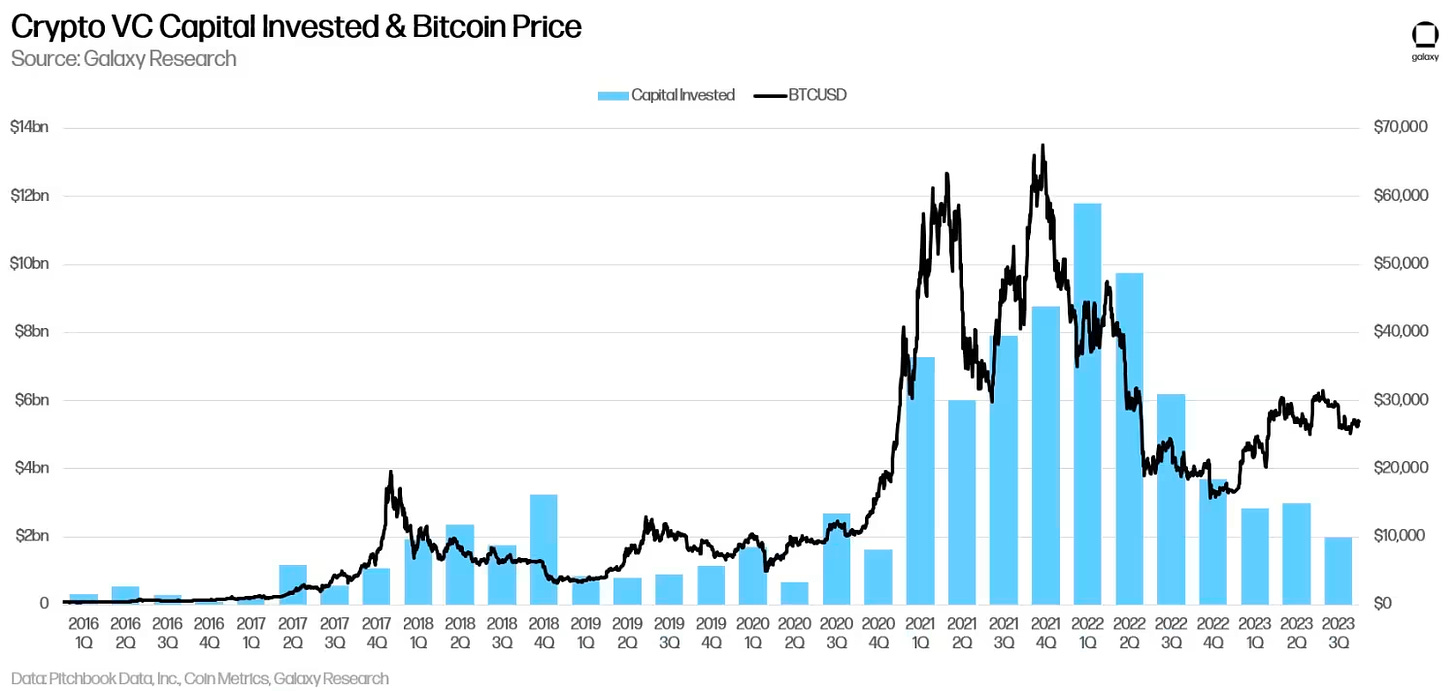

Also, don’t forget that Crypto VC funding tends to be correlated with BTC price:

Top Six Crypto Funding Rounds

Blockaid | $27M | Series A | 10/23/2023

Blockaid, a Web3 security company used by firms like Metamask and Opensea, has raised a $27 million Series A led by Ribbit Capital and Variant. The round also saw participation from Cyberstarts, Sequoia Capital, and Greylock Partners. Blockaid claims to have scanned 450 million transactions, thwarted 1.2 million malicious transactions, and safeguarded $500 million in user funds in the last three months.

Blackbird | $24M | Series A | 10/4/2023

Crypto venture firm Andreessen Horowitz led a $24 million Series A funding round for Blackbird Labs, the team building the web3 restaurant loyalty app Blackbird. Additional participants in the round include QED, Union Square Ventures, Shine, Variant, and various restaurant groups. The Series A fundraise brings Blackbird's total funding to $35 million, which the firm intends to use to scale operations.

SynFutures | $22M | Series B | 10/19/2023

SynFutures, a decentralized crypto derivatives exchange, has completed a $22 million Series B funding round. Pantera Capital led the round, with participation from HashKey Capital and SIG DT Investments, a member of the Susquehanna International Group. SynFutures is rolling out its proprietary automated market maker (AMM) called Oyster alongside its new raise. AMM, which emerged with the rise of decentralized finance or DeFi, uses algorithmic robots to make it easier for traders to buy and sell crypto assets, rather than having them trade with a traditional order book.

Animoca Brands | $50M | Strategic Financing | 10/30/2023

Animoca Brands has raised US$20 million (approximately A$31.3 million) via the issue of new ordinary shares at a price per share of A$4.50; as part of the raise, the Company has granted to the investors in the round a free-attaching utility token warrant on a 1:1 dollar basis.

Shrapnel (Neon Machine) | $20M | Series A | 10/25/2023

Web3 gaming developer Neon Machine raised $20 million in Series A funding toward the development of its highly anticipated extraction shooter, Shrapnel. This round follows a $10.5 million seed round completed in June of 2021. It was led by Polychain Capital and included funding from Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures and Tess Ventures. Shrapnel is an ambitious gaming project touted by Neon Machine as a AAA game - an expression for video games with top-tier production value, budgeting and marketing.

Membrane Labs | $20M | Series A | 10/11/2023

Membrane Labs, a cryptocurrency-focused trading and lending platform, has raised $20 million in a Series A funding round, with participation from big names like Brevan Howard Digital and Point72 Ventures. The capital will be used to help build the type of grown-up trading infrastructure the crypto space needs in order to avoid further disasters. Other notable names included in the round were Jane Street, Flow Traders, QCP Capital, Two Sigma Ventures, Electric Capital, Jump Crypto, QCP Capital, GSR Markets, Belvedere Trading, and Framework Ventures.

Click to see all of October's funding rounds here:

October Crypto VC Fund fundraise Announcements

Yes, new crypto VC funds continue to announce their successful fundraises. We’ll flag them here when they’re announced.

24-Oct-23: Nym Technologies Attracts $300M in Crypto Fund Commitments for Privacy Infrastructure. The fund will provide capital to crypto builders, developers and communities with a focus on privacy, which aims to prioritize users' anonymity during financial activities. It has received commitments from investors such as Polychain, KR1, Huobi Incubator and Eden Block, among others.

4-Oct-23: CMCC Global Raises $100M for Hong Kong-Based Blockchain Companies. The lead investor in the fund was B1, which committed $50 million, alongside Richard Li’s Pacific Century Group, Tyler and Cameron Winklevoss’ firm and Animoca Brands founder Yat Siu. The Titan Fund, as it is called, will make early-stage investments in companies across Web3 sectors such as gaming, the metaverse and non-fungible tokens (NFTs).

Hackathons

Ongoing

Web3 Global Hackathon 2023 AW September 30 - December 9

$78,000 Available in prizes.

Upcoming

ETH Lisbon November 3 - 5

$80,000 Available in prizes.

Nearcon (Lisbon) November 7 - 10

$140,000 Available in prizes.

ETH Global Istanbul November 17 - 19

$625,000 Available in prizes.

OpenFort Game On Barcelona November 25-26

$10,000 Available in prizes.

Recently Completed (finalists in the links)

ETH Online October 6 - 27

Bitcoin Olympics Hackathon August 9 - September 30

Paradigm Consumer Hackathon October 27

Neo APAC Hackathon July 22 - October 15

Hyperdrive Hackathon September 6 - October 15

Demo Days

Upcoming

OPL x SEI Incubator Demo Day November 6

Conviction Investor Demo Day November 9

AI/ML Space for Maritime - Demo Day November 9

Recently Completed

Orange DAO Fellowship 2 (OF2): Demo Day October 3

Outlier Ventures x Aptos Move Accelerator October 26

LBanks Labs Demo Day October 19

That’s a wrap for October.

Did you enjoy this newsletter or the data? Please share it with a friend, and THANK YOU for your time.

Good luck out there!

Ben