Gm!

Please enjoy the July Deal Flow Digest, a monthly newsletter recapping recent Crypto / web3 funding rounds.

Be sure to check out the Airtable below with ALL the deals, and the recent hackathon/demo day results (in the links).

The Ethereum ETF is here

Summer lull? Perhaps. But Crypto had a pretty darn eventful July.

While in this “lull” where everyone is on vacation, a reminder of some of the significant crypto things that happened in July:

Germany sold all of its Bitcoin Holdings ($2.9B)

Donald Trump Spoke at Bitcoin Conference. So did RFK.

ETH CC Conference - where I hosted an absolutely massive run.

US Debt hits ATH of $35 trillion.

Crypto Super PAC Fairshake Is Now the Largest Super PAC in the US, Raising >$200mm

Tether reports profit of $5.2 Billion for 1H24.

Crypto is now a major talking point with the election and… It’s pretty wild.

For most people “crypto” is this big opaque category - but mostly Bitcoin. Sitting at a $1.3T Market Cap, Bitcoin is >50% of the cryptocurrency market. So that makes sense.

Bitcoin is easier to understand. It was the first. It is digital gold. It’s providing Digital Property rights. Or as Blackrock’s Larry Fink says, “It is a legitimate financial instrument that allows you to have maybe uncorrelated, non-correlated type of returns,” - a potential hedge against countries debasing their currencies.

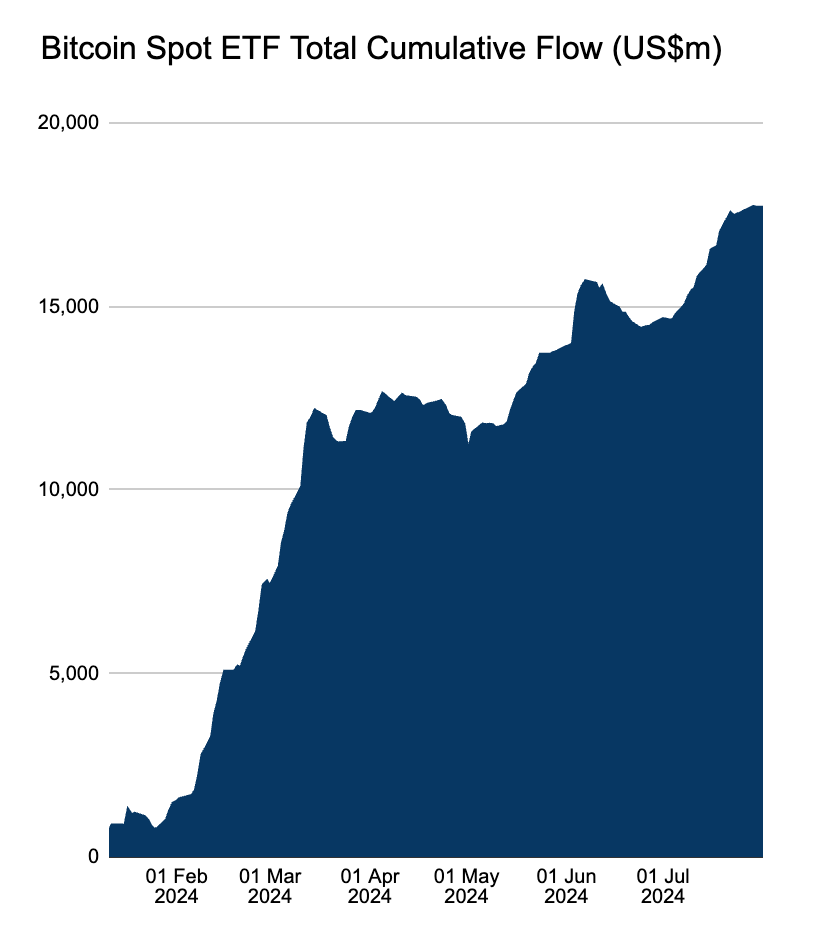

Clearly the world is starting to understand. They’re also starting to allocate to it.

In July, we got the Ethereum (ETH) ETF.

People are just finally wrapping their heads around Bitcoin - Now, how do you explain Ethereum?

I’m biased, but I really liked the Bankless episode: “Ethereum ETF Pitch Battle: How to Sell ETH to Wall Street!”

Here is RSA’s pitch (only) here: https://x.com/BanklessHQ/status/1804554072051089609

How do they pitch it? Some quotes from the episode here that encapsulate “Pitching ETH to Wall Street”:

Ethereum is like Bitcoin, but with the addition of programmability. Ethereum's programmability evolves Ethereum beyond just being a scarce digital asset to being able to host an entirely online digital economy. This programmability enables Ethereum to be a platform for financial applications.

Ethereum is an open platform for anyone to build whatever financial application that they can imagine. Since Ethereum is an internet-based protocol, It has an internet-scaled distribution. The applications on Ethereum are accessible to anyone with an Internet connection making these applications on Ethereum some of the most widely-used and fastest-growing financial service applications that have ever existed.

Bitcoin is one asset. It's just Bitcoin. Ethereum is all possible assets, which is bigger gold, or all the assets in the world. Bitcoin was designed to secure one asset, just Bitcoin. Ethereum is a general purpose platform designed to secure everything else. Stable coins, loans, equities, bonds, derivatives, everything in finance.

People like Larry Fink are saying every stock, bond, and asset will be tokenized on a global ledger, and even he's thinking too small. Tokenization isn't just the assets of the past. It's the assets of the future. AI compute, personal data, social status, and celebrity - everything will be tokenized Ethereum is a global computing network to tokenize and program any asset.

Ethereum adds property rights to the internet. Now tokenization can and will happen on other platforms. But Ethereum is positioned as the strongest contender to ride the tokenization wave, there's 100 million people that own ETH. 100,000 developers that actively contribute to the code already.

The cryptocurrency of Ethereum is called ETH. It has investable economics, including an algorithmic buyback and dividend program that drives billions per year in earnings to ETH holders. This number grows as the network expands. You can build a DCF model on ETH as you would with any stock.

ETH is extremely secure and decentralized like Bitcoin, more and more people are seeing ETH as a complement to Bitcoin as a store of value. While Bitcoin has greater certainty of supply, Ethereum pays a dividend and is deflationary with the upside of an entire token economy.

Bitcoin is exposure to digital gold, Ethereum is exposure to everything else.

So if you're bullish on the growth and adoption of crypto and blockchain technology at large, the Bitcoin ETF simply doesn't offer that exposure you need the ETH ETF.

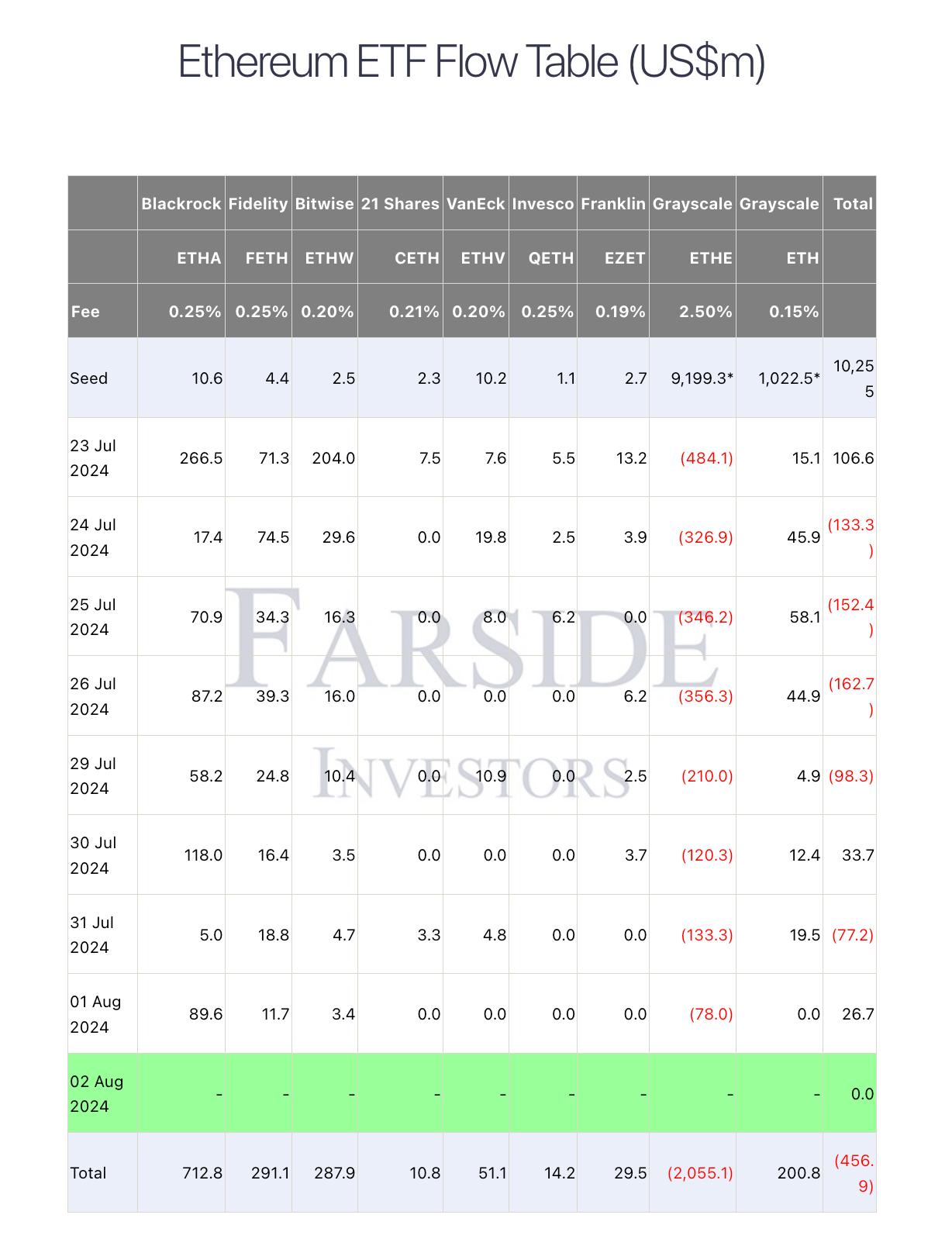

The Ethereum ETF launched on 23-July-24, one week after its 9th birthday. How has it done?

Just over a week into the ETF Trading. Middle of the summer, but still looking pretty darn good. Bring on the volumes. Bring on the institutional allocators. Where does it go from here? No idea.

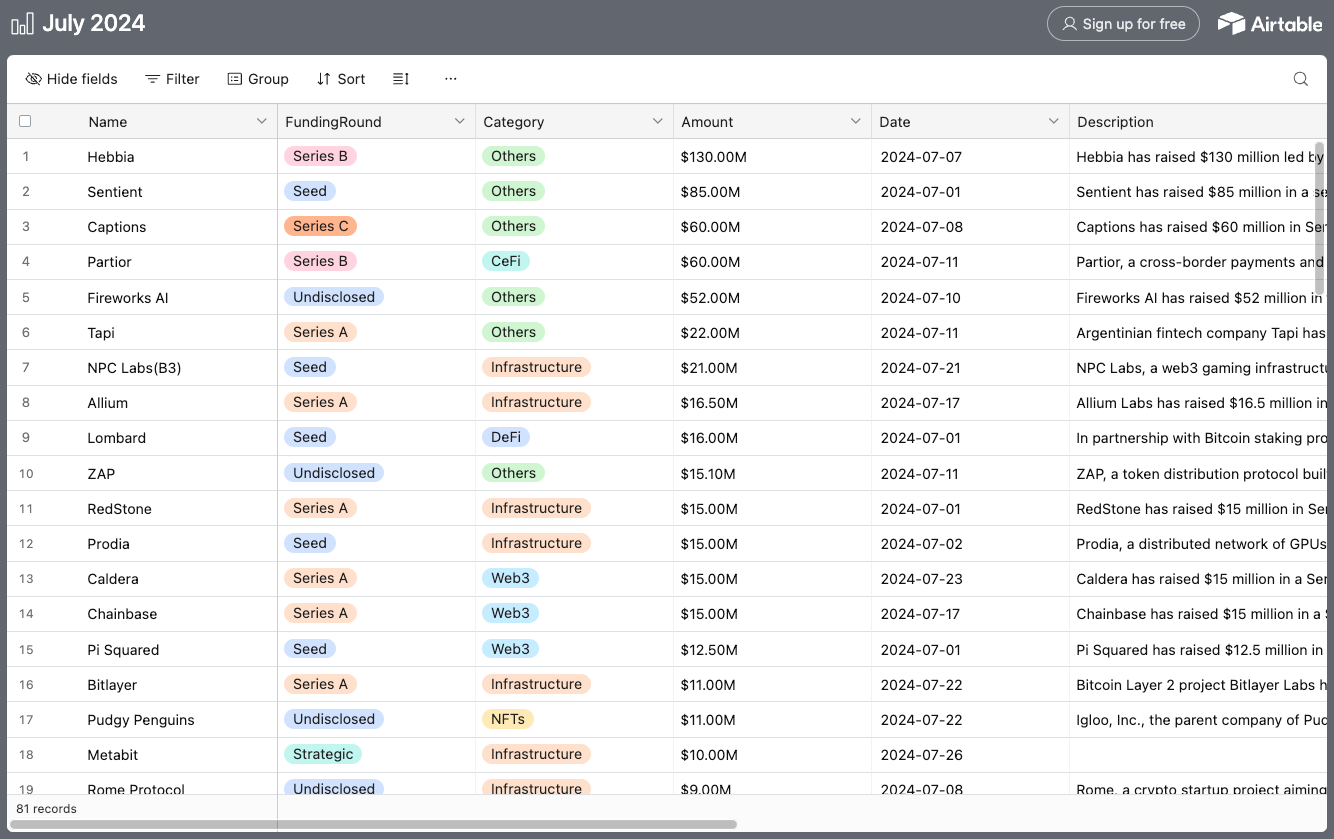

Top 10 Crypto Funding Rounds

Sentient | $85.00M | Seed | 2024-07-01

Sentient has raised $85 million in a seed funding round. Singapore-based Sentient Labs is building an open-source platform through which developers can get paid for their contributions to emergent AI tools, such as chatbots and enterprise software. The fundraising comes ahead of the Sentient platform’s planned testnet launch, scheduled for the third quarter. Peter Thiel's Founders Fund, Pantera Capital and Framework Ventures co-led the mega round, other investors in the round included Ethereal Ventures, Robot Ventures, Symbolic Capital, Delphi Ventures, Hack VC, Arrington Capital, Hashkey Capital, Canonical Crypto, Foresight Ventures and others.

Partior | $60.00M |Series B | 2024-07-11

Partior, a cross-border payments and settlement blockchain company, raised more than $60 million Series B funding round led by Peak XV Partners, with other investors including Jump Trading and Valor Capital.

Tapi | $22.00M | Series A | 2024-07-11

Argentinian fintech company Tapi, a payments processor for consumer-facing platforms, has successfully raised $22 million in a Series A funding round led by Kaszek, with participation from Andreessen Horowitz (a16z).

NPC Labs(B3) | $21.00M | Seed | 2024-07-21

NPC Labs, a web3 gaming infrastructure startup co-founded by three former Coinbase employees, has raised $21 million in pre-seed and seed funding rounds. Pantera Capital led the latest seed round worth $18 million, bringing NPC Labs' total funding to $21 million, including a recent pre-seed round worth $3 million, the startup said Monday. Other investors in the rounds include Makers Fund, Hashed, Collab+Currency, Sfermion, Mirana Ventures, Bitscale Capital and Mantle EcoFund.

Allium | $16.50M | Series A | 2024-07-17

Allium Labs has raised $16.5 million in a Series A round led by Theory Ventures. Seed investors Kleiner Perkins and Amplify Partners also participated. Allium provides enterprise-grade, quick, and simple blockchain data for leading institutions and companies like Visa, Stripe, Uniswap Foundation, and Phantom to easily answer strategic questions, identify investment and growth opportunities, manage business reporting, and power their applications. Allium Labs has previously partnered with Visa to create the Visa OnChain Analytics Dashboard, which currently focuses on providing clear insights into stablecoin activity.

Lombard | $16.00M | Seed | 2024-07-01

In partnership with Bitcoin staking protocol Babylon, the startup Lombard has raised $16 million to build out Bitcoin-based restaking. In addition to capitalizing on the restaking hype, Lombard is the latest startup to integrate Bitcoin into the wider world of decentralized finance (DeFi) – an industry that so far has mostly been lacking on Bitcoin.

ZAP | $15.10M | 2024-07-11

ZAP, a token distribution protocol built on the Ethereum Layer 2 network Blast, announced raising $15.1 million in total funding. Investors in ZAP's seed and private rounds included Rarestone Capital, Cypher Capital, Sharding Capital, Luca Netz of Pudgy Penguins, Larry Cermak of The Block and Chelsea Jiang of Foresight Ventures."

RedStone | $15.00M | Series A | 2024-07-01

RedStone has raised $15 million in Series A funding round led by Arrington Capital. RedStone is a blockchain oracle similar to popular oracles like Chainlink and Pyth Network, but it differentiates itself with a modular design. Other participants in this round included SevenX, IOSG Ventures, The Spartan Group, White Star Capital, Kraken Ventures, Amber Group, Protagonist, gumi Cryptos, Christian Angermayer's Samara Asset Group and HTX Ventures. The new funding will be used to hire new team members.

Caldera | $15.00M | Series A | 2024-07-23

Caldera, a "rollup-as-a-service" platform that helps developers quickly spin up layer-2 blockchains, has raised $15 million in a Series A funding round. Peter Thiel's Founders Fund led the round, with participation from Dragonfly, Sequoia Capital, ArkStream Capital, Lattice and others.

Chainbase | $15.00M | Series A | 2024-07-17

Chainbase has raised $15 million in a Series A funding round. Chainbase describes itself as an omnichain data network that consolidates all blockchain data into a single platform, making it easier for developers to access and use for building and maintaining applications. Tencent Investment Group and Matrix Partners China co-led the round. Other investors included Folius Ventures, Hash Global, Jsquare, Mask Network and Bodl Ventures.

Click to see all of July’s funding rounds here:

July Crypto VC Fund fundraise Announcements

VCs are starting to announce their new raises…

2024-07-08: Digital Asset Trader Auros to Invest Over $50M in Crypto Startups Through Its Newly Established VC Arm. Crypto trading firm and market maker Auros said in an exclusive interview with CoinDesk that its newly established venture capital arm plans to invest more than $50 million of its own capital in early-stage digital asset ventures in the next two years.

2024-07-09: Frictionless Announces Fund I. Frictionless Capital is excited to announce it has raised a $20M fund to invest in high performance blockchains and category defining applications. The fund has made a number of high-conviction investments over the past year such as Backpack, DFlow, Andrena, and Kuzco and is eager to share more about our progress and approach to investing.

2024-07-10. Crypto VC Hypersphere opens $130 million liquid fund, seeks $75 million for new VC fund. In addition to Atlas, Hypersphere is also set to raise a new venture fund to invest in early-stage crypto projects. The firm is eyeing $75 million for the VC fund, Platts told The Block, adding that the fundraising will start in the fall.

2024-07-19. Bitrue Ventures launches Web3-focused $40M investment fund. The investment and research arm of crypto exchange Bitrue opened up a $40 million pool of investment funds dedicated to the Web3 ecosystem. Bitrue Ventures’ $40 million fund will be divided among several Web3 startups and developers, who are eligible to get up to $200,000 investment.

2024-07-25: Galaxy Digital Secures $113M for Crypto Venture Fund, Eyes $150M Target. Galaxy Digital has successfully raised $113 million for its new crypto venture capital (VC) fund, which aims to support early-stage startups focusing on crypto software, infrastructure, and financial applications. This significant funding effort, spearheaded by the asset management unit of billionaire Michael Novogratz, targets a total of $150 million.

Hackathons

Ongoing

L1X Hackathon June 28 - September 6

$500k Available in prizes.

TRON Grand Hackathon July 25 - October 8

$350k Available in prizes.

Superhack 2024 August 2 - 16

$200k Available in prizes.

Finished (results in links)

Theta Network May 8 - July 23 (results pending)

$250k Available in prizes.

ETH Global Brussels July 12-14

$475k Available in prizes.

Upcoming

ETH Online August 23 - September 13

$186k Available in prizes.

ETHGlobal Singapore September 20 - 22

$350k Available in prizes.

ETHGlobal San Francisco October 18 - 16

$200k Available in prizes.

Demo Days

Meta Solutions August 13 - 14

Virtual

Supra September 9

Seoul, Korea

Open Accelerator Applications

Boba Liftoff Accelerator

Virtual

Bring x XDC Launch Program

Virtual

Alliance

Virtual

That’s a wrap for July.

Did you enjoy this newsletter or the data? Please share it with a friend, and THANK YOU for your time.

Thank you and good luck out there!

Ben Lakoff, CFA

Twitter: https://twitter.com/benlakoff