Gm!

Please enjoy the April Deal Flow Digest, a monthly newsletter recapping recent Crypto / web3 funding rounds.

Be sure to check out the sheet below with ALL the deals, and the recent hackathon/demo day results (in the links).

Bitcoin

On 3 January 2009, as Bitcoin’s first block was mined, Satoshi Nakamoto encoded a not‑so‑subtle headline: “Chancellor on brink of second bailout for banks.”

Bitcoin was not born of divine mathematical inspiration…it was born of disgust with a financial system that shields incumbents from the consequences of their own excesses.

Sixteen years later, the Bitcoin network has matured into a multi‑trillion‑dollar economy and, ironically, the very institutions it sought to bypass are now among its largest bagholders.

In this piece I attempt to explain why public companies such as Strategy (NASDAQ: MSTR — the company formerly known as MicroStrategy), the newly‑formed Twenty One Capital, and many others are stuffing their treasuries with bitcoin, how the mechanics work, and what that means for a technology designed to be permissionless.

Bitcoin is increasingly recognized as “Digital Gold”, combining attributes of physical gold with advantages of digital technology.

Finite supply – A hard cap of 21 million coins creates gold-like scarcity.

Hedging asset – Used as a potential safeguard against currency debasement and geopolitical turmoil.

Portable & digital – Transfers globally in minutes and stores friction-free, unlike physical commodities.

Deflationary supply – Rising mining difficulty continually amplifies the value proposition of existing coins.

Insulated from external actors – Operation is permissionless; no central bank or Wall Street gatekeeper controls issuance or settlement.

Global liquidity – Deep, 24/7 trading across hundreds of exchanges and OTC desks worldwide.

Decentralized architecture – A distributed blockchain provides real-time auditability without single points of failure.

Security & transparency – Transactions are secured by cryptography and permanently recorded on an immutable public ledger.

More adoption means the game is changing.

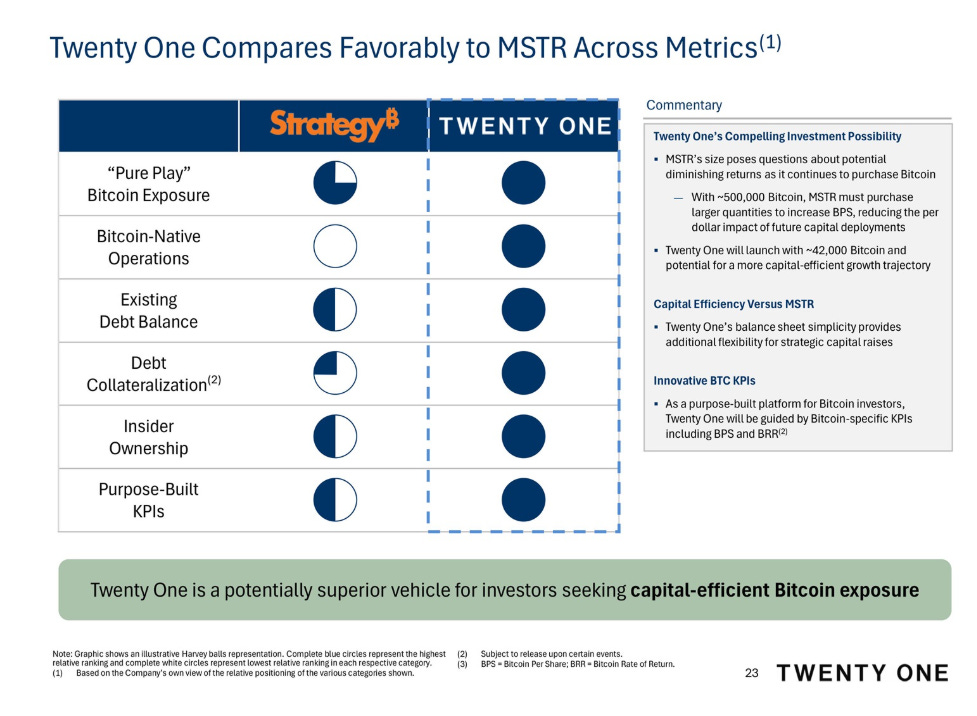

This was a great slide from Twenty One Capital’s new SEC Filing, a new venture aiming to mimic the success of MSTR but with key backers including Cantor Fitzgerald, Tether, Bitfinex, and SoftBank…

The Strategy/MicroStrategy (MSTR) Strategy (yes, MicroStrategy rebranded to “strategy” now it’s very confusing.)

A slide from their deck shows the sheer size of this. Please note that this slide is from 28-March-25, since then Strategy/MicroStrategy (MSTR) has already sold more stock & preferred shares under its giant 21 / 21 at-the-market (“ATM”) shelf for ~$555.55M and has purchased an additional 6,556 BTC.

Filed with the SEC on 28 March 2025, Twenty One is a Cantor‑Fitzgerald‑sponsored SPAC backed by Tether, Bitfinex, and SoftBank. It launches with 42,000 BTC (~US $4 B) on day one, instantly placing it among the top corporate holders and setting up a direct rivalry with Strategy. Beginning smaller gives existing shareholders more torque on future BTC‑funded equity raises.

Strategy’s playbook is spreading - not just in other markets and not just for Bitcoin. Janover (NASDAQ: JNVR), for example, has announced a SOL‑focused balance‑sheet strategy, and more single‑asset treasuries are in the pipeline.

Why it works:

Cheap leverage on a long‑vol asset: Zero-coupon convertibles and non-dividend stock sales let Strategy borrow or issue equity at negative carry when BTC is rising. That’s effectively a synthetic long-dated call option on Bitcoin funded by markets that want exposure.

Elastic supply of capital: By using an ATM instead of block deals, Strategy taps liquidity only when the bid is there—minimising price impact and keeping optionality for the next draw-down.

Convexity: Even after ~32 B raised, the financing stack remains mostly zero-coupon or low-coupon; cash interest expense is trivial versus potential BTC upside. As long as BTC’s 4-year CAGR stays above ≈ 15 %, dilution and interest are dwarfed by mark-to-market gains

The bigger existential risk now is not debt service, but whether the market keeps assigning a premium to MSTR equity when the next shelf refresh is needed. The Achilles heel is equity appetite. If that premium closes while BTC stagnates, the model’s flywheel stalls.

Institutional embrace boosts price and legitimacy, but it also channels vast swathes of bitcoin into KYC‑bound vaults, concentrates custody with a handful of regulated intermediaries, and hands governments single‑point leverage. As ETFs, corporate treasuries, and broker‑dealers accumulate “paper BTC,” the network’s censorship‑resistance and decentralized ownership could erode—turning a once‑radical bearer asset into a surveilled financial product that mirrors the system it set out to disrupt.

Top 9 Crypto Funding Rounds

Sol Strategies | Post-IPO | DeFi | $500M | 2025-04-22

Sol Strategies raised $500M in a Post-IPO financing round. The investor was not disclosed.

Auradine | Series C | Infrastructure | $153M | 2025-04-15

Auradine, a provider of blockchain and AI infrastructure solutions, raised $153M in its Series C round to bolster AI and blockchain infrastructure.

LayerZero | Undisclosed | Infrastructure | $55M | 2025-04-16

LayerZero, a Web3 company running a crosschain messaging protocol, raised $55M in a round led by Andreessen Horowitz.

Blackbird | Series B | Web3 | $50M | 2025-04-07

Blackbird Labs, a blockchain-based restaurant loyalty and payments app, raised $50M in a Series B funding round.

Meanwhile | Series A | Infrastructure | $40M | 2025-04-09

Meanwhile, a bitcoin-based life insurance startup, raised $40M in a Series A led by Framework Ventures and Fulgur Ventures.

Symbiotic | Series A | Infrastructure | $29M | 2025-04-22

Symbiotic, a staking protocol, raised $29M in a Series A round led by Pantera Capital and Coinbase Ventures to launch a blockchain coordination layer.

Camp Network | Series A | Others | $25M | 2025-04-28

Camp Network raised $25M to support content creators amid rising lawsuits against AI firms over unauthorized use of copyrighted material.

Miden | Seed | Infrastructure | $25M | 2025-04-28

Miden, a privacy-focused protocol spun out of Polygon, raised $25M in a seed round to build out its ecosystem and developer tools.

Theo | Undisclosed | DeFi | $20M | 2025-04-23

Theo, a NYC-based DeFi firm connecting onchain capital to global markets, raised $20M in a round led by Hack VC and others.

Click to see all of April’s funding rounds here:

April Crypto VC Fund fundraise Announcements

VCs are continuing to announce their new raises.

2025-04-07: MANTRA Chain launches $108,888,888 Ecosystem Fund (MEF) to accelerate real-world asset (RWA) tokenization and DeFi innovation. The four-year initiative will fund high-potential blockchain projects globally.

2025-04-09: Aethir launches $100 million ecosystem fund to support real-world asset (RWA) tokenization projects. The fund aims to accelerate the adoption of decentralized infrastructure and tokenized assets.

2025-04-21: Astra Fintech launches $100 million Solana Ecosystem Fund to support blockchain-based payment innovation and expansion across Asia.

2025-04-24: RockawayX closes $125 million early-stage crypto fund, doubling down on Solana ecosystem investments. The fund will also support DeFi infrastructure and decentralized networks, with a hands-on approach including liquidity provision, validator operations, and hardware deployment.

2025-04-29: ether.fi launches $40 million Ventures Fund I to back bold founders building open, decentralized systems. The fund’s first investments include Resolv, Rise Chain, and Symbiotic.

As a reminder, if you are interested in learning more about Bankless Ventures Fund II, please fill out this form and we will be in touch!

Hackathons

Upcoming

EasyA Consensus | May 14 - 16

Toronto. $400k in prizes.

ETHGlobal Prague | May 30 - June 1

Prague. $175k in prizes.

Broker API Hackathon | May - Oct

Virtual. $1M USDT in prizes.

Finished (results in links)

ETHGlobal Taipei | April 4 - 6

Taipei/Virtual. $175k in prizes.

Start in Block | April 8 - 10 (Paris Blockchain Week)

Paris/Virtual. $10M in prizes.

[REDACTED] Hackathon | April 1 - 30

Virtual. $150k in prizes.

Demo Days

Upcoming

Hedera x AI Agents Demo Day | May 10

Virtual

Techstars Web3 Demo Day | June 5

New York

Finished (results in links)

OnePiece Labs x Camp Network | April 3

Orange DAO | April 24

Open Accelerator Applications

Alliance DAO | Apply by May 28

New York

Blockchain for Good Alliance | Open

Virtual

Acceleratooor | Apply by May 28

Virtual

That’s a wrap for April!

Thank you and good luck out there!

Ben Lakoff, CFA

https://twitter.com/benlakoff